Discover how utilizing publicly accessible business intelligence platforms can help uncover and identify potential money laundering patterns.

Money laundering, the process of concealing illegally obtained funds to appear legitimate, represents a major challenge in global finance. While precise measurements are complex due to their clandestine nature, the United Nations Office on Drugs and Crime (UNODC) estimates that 2-5% of global GDP—approximately EUR 715 billion to 1.87 trillion annually—is laundered every year.

Organized criminal groups, authoritarian regimes and terrorist networks employ sophisticated methods to launder money using the following three general phases:

- Placement: Initial introduction of illicit funds into the financial system, often through cash-intensive businesses or currency exchange operations

- Layering: Complex series of transactions to obscure the money trail, this includes doing the following:

- Property acquisitions

- Shell company formations

- Cross-border wire transfers

- Commodity trading

- Investment in high-value assets

- Integration: Re-introduction of funds into a legitimate economy through seemingly legal business operations and investments

Open-source intelligence (OSINT) resources and business databases can be leveraged to detect laundering indicators at each phase. This guide will focus on utilizing publicly accessible business intelligence platforms to identify potential money laundering patterns.

Global corporation databases search techniques

Global corporation databases play an important role in the fight against financial crimes like money laundering, terrorist financing and corruption. They provide access to a wealth of information about corporate management structures, ownership information and financial records. This enables investigators, regulators and businesses to identify risks, conduct due diligence and trace illicit money flows.

How global corporation databases facilitate online investigation

Global corporation databases aggregate data from various sources, such as public business registries, regulatory filing bodies, court records and commercial data providers. This comprehensive data collection creates a detailed profile for each company. In the following section, we will discuss how these databases help fight money laundering activities:

Understanding corporate structures

Organized criminal groups employ complex corporate networks, primarily shell companies and offshore entities, to conceal the real owners of their assets and money. Investigators use global databases to create detailed maps of these business connections, which helps expose who actually controls these companies. The Panama Papers investigation effectively demonstrates this—investigators used global database information to expose how wealthy individuals and major corporations utilized offshore shell companies to hide their assets and avoid paying taxes.

Identifying ownership

Tracking down actual company ownership is critical in evaluating risks and following illegal money trails. Criminals create complex networks of legal entities to conceal their involvement, hiding illicit funds' origins. Global databases are vital for searching through these layers by revealing the beneficiaries behind these structures. A prime example is the 1MDB investigation, where investigators used global databases to map out how criminals laundered billions from Malaysia's state fund by routing money through a complex network of shell companies and offshore accounts.

Analyzing financial records

Financial intelligence databases give access to comprehensive corporate documentation, such as balance sheets, profit-loss statements and creditworthiness assessments. This financial visibility allows investigators to conduct detailed analyses of organizational financial patterns and stability metrics.

Key examination elements include:

- Variance between reported earnings and transaction amounts

- Unexplained capital inflows or outflows

- Misalignment between business model and financial activity

- Stark discrepancies between declared revenues and operational scale

For instance, a retail enterprise declaring consecutive quarterly losses while executing large international transfers presents notable irregularities warranting deeper scrutiny. Cross-border database integration allows investigators to track financial footprints across jurisdictions, which helps them reveal potential data inconsistencies and suspicious patterns that may indicate laundering operations.

Conducting due diligence

We can use global corporate databases to conduct Know Your Customer (KYC) and Customer Due Diligence (CDD) checks to ensure we are not dealing with sanctioned entities or individuals involved in illicit activities. This verification framework forms a cornerstone of AML regulatory adherence. For example, a bank can use a global database of sanctioned entities to verify the identity of a new corporate client. Suppose the search reveals that the client’s CEO is on a sanctions list or a partner of this company is sanctioned by the EU or USA; this will allow the bank to reject the client and report the finding to regulators to avoid becoming in a non-compliance status.

Investigating financial crime

Regulatory bodies and law enforcement units leverage these intelligence platforms to:

- Map illicit fund movements

- Document financial crime patterns

- Construct evidence chains

- Link seemingly unrelated entities

The Danske Bank money laundering case demonstrates this investigative approach. Investigators employed global databases to track suspicious transactions worth billions of dollars through the Estonian branch operations. This data-driven investigation revealed the following:

- Complex networks of shell companies

- Links to organized crime syndicates

- Systematic suspicious transaction patterns

- Cross-border money movement schemes

Examples of widely used global databases

There are many global corporate databases for getting various information about corporations worldwide, here are the most prominent ones:

- OpenCorporates: A large, open-source database that contains a repository of corporate entities, documenting registered identities, physical locations and leadership structures

- Orbis: A commercial database that provides comprehensive information on millions of companies worldwide

- Dun & Bradstreet: A well-established provider of business information and credit reporting services

- Bloomberg: A financial data and news provider that offers access to a vast database of company information, including financials, ownership data and legal documents

- Beauhurst: Provides data on every private company in the UK and Germany

- Companies House: United Kingdom's authoritative business registry

- Securities and Exchange Commission: the US government agency that oversees the stock market

- European Business Register: The EU business register

- OFAC - Sanctions Programs and Country Information: The OFAC administers several different sanctions programs for the US government

- EU Sanctions Map: List of entities sanctioned by the EU countries (see Figure 1)

- Mergent Online: A Global corporate intelligence repository delivering extensive entity documentation, including financial statements, organizational narratives, property holdings, subsidiary networks, executive profiles and board structures

- Crunchbase: A database for all private and public companies

Figure 1 - EU sanctions list map

Using advanced research techniques – Google Dorks – to find corporate data

Money laundering investigations require investigators to search through vast amounts of data to uncover hidden connections, trace illicit funds and identify red flags. Advanced search techniques, such as Google Dorking, can streamline this process. Dorking allows investigators to search for specific types of information on the Internet, including publicly available financial records, hidden corporate relationships and leaked or unpublished data. Here are some Google Dorkings to find different information that can aid investigators in money laundering investigations.

Searching for financial records

Financial records, such as annual reports, financial statements and regulatory filings, can provide critical insights into a company’s financial health and transaction patterns. These documents are often published on government or corporate websites and can be located using the following search queries:

site:.gov filetype:pdf "annual report" + "Company Name"

This search query searches for annual reports published on USA government websites (.gov) in PDF format for a specific company

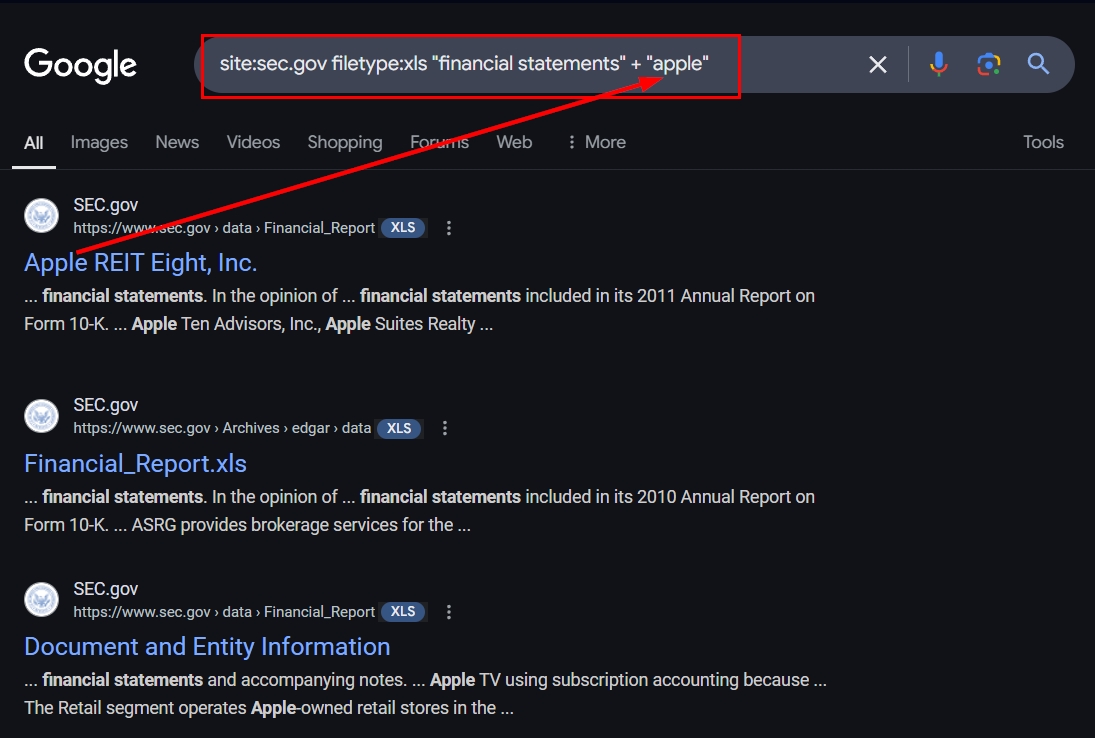

site:sec.gov filetype:xls "financial statements" + "company name"

This search query searches for financial statements filed with the U.S. Securities and Exchange Commission (SEC) in Excel format. We can change the filetype to PDF, doc,docx or xlsx (see Figure 2)

Figure 2 - Using Google Dorks to search for companies' financial records on the USA sec.gov organization

site:companieshouse.gov.uk filetype:pdf "annual accounts" + "Company Name"

Searches for annual accounts filed with the UK Companies House for a specific company

Identifying hidden corporate relationships

Criminal groups commonly create elaborate networks of businesses that combine shell companies with offshore entities to hide who owns their assets. Identifying these hidden relationships is critical for tracing illicit funds and uncovering the actual owners. Here are some Google dorks examples to reveal such information.

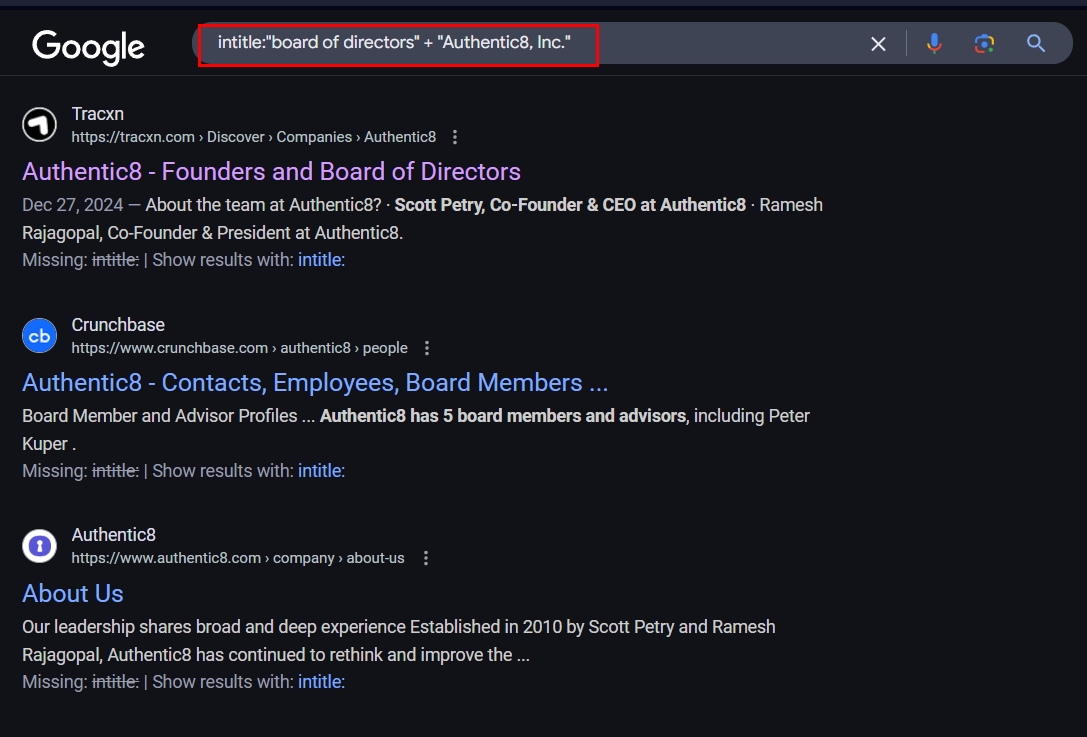

intitle:"board of directors" + "Company Name"

This search query searches for web pages listing a specific company's board of directors. This can help identify key individuals and their connections to other entities. We can exchange the “board of directors” with “founders” or “Leadership Team” (see Figure 3).

Figure 3 - Finding a company leadership team members

Locating leaked or unpublished data

Leaked or unpublished data, such as financial transactions, internal memos or offshore account details, can provide critical evidence in money laundering investigations. These documents are often stored using specific file formats and can be located using the following Google Dorks.

filetype:xls "financial transactions" + "offshore"

This search query searches for Excel files containing information about financial transactions linked to offshore accounts

filetype:csv "wire transfer" + "Bank Name"

Searches for CSV files containing wire transfer data from a specific bank

filetype:pdf "confidential" + "internal memo" + "Company Name"

This search query searches for confidential internal memos related to a specific company

Techniques and tools for business relationship mapping

Business relationship mapping is the process of visualizing and analyzing the connections between different companies, individuals and other entities to uncover hidden relationships and suspicious activities. This technique is essential for identifying complex corporate structures, such as shell and offshore companies and networks used for money laundering, fraud or corruption. By mapping these relationships, investigators can trace the flow of funds, identify ultimate beneficial owners and detect red flags.

Visualization tools

Visualization tools facilitate the creation of visual representations of complex networks, making it easier for investigators to identify patterns and business/personal connections.

Here are some tools for relationship visualization:

- Gephi: An open-source tool for network analysis

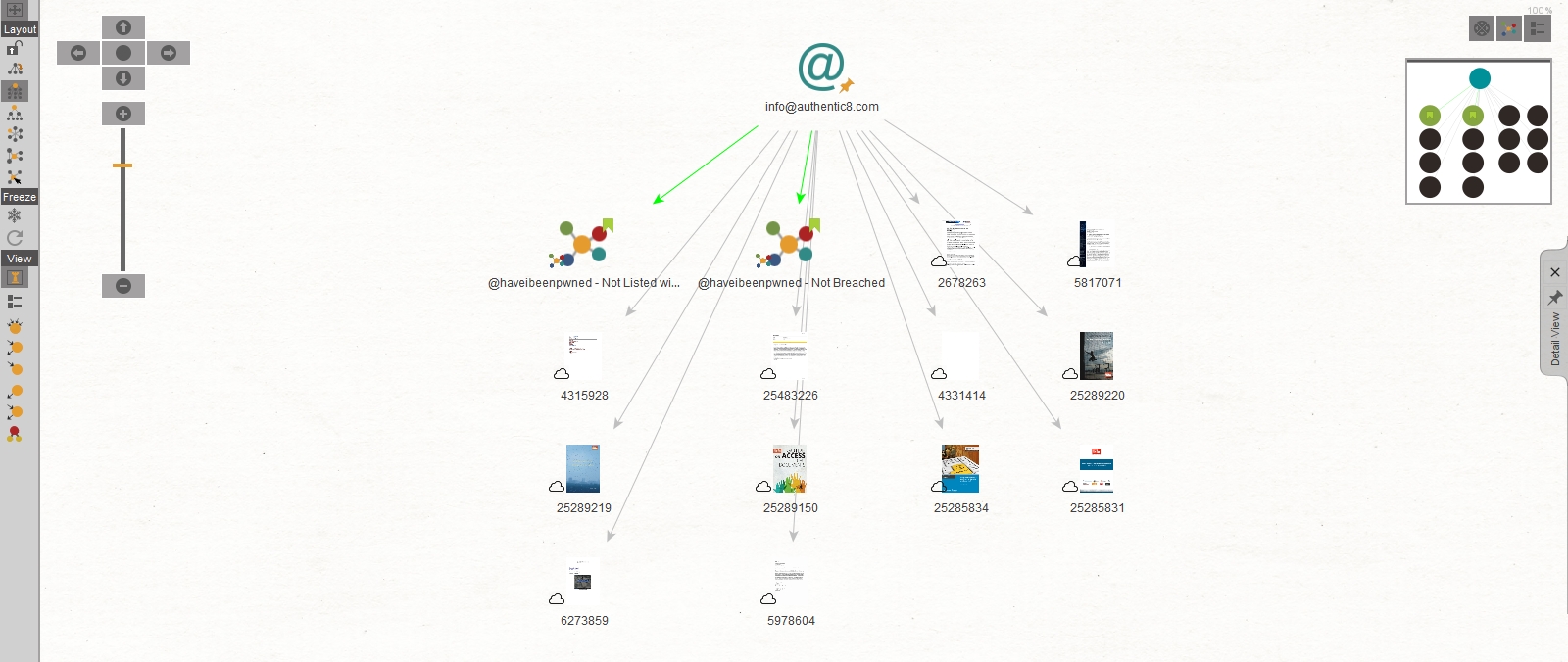

- Maltego: A commercial tool (there is a community version with limited functionality) for link analysis. For example, Maltego can be used to trace the connections between a target’s email addresses, social media profiles and corporate affiliations (see Figure 4)

- Cytoscape: An open-source platform for complex network analysis

Figure 4 - Maltego interface

Money laundering involves three phases: placement, layering and integration. Global corporation databases are considered essential tools for detecting and investigating financial crimes, offering comprehensive data about corporate structures, ownership and financial records. These databases, including OpenCorporates, Orbis and Bloomberg, help investigators trace illicit funds and conduct due diligence. Advanced search techniques like Google Dorking can uncover hidden corporate relationships and financial records. Business relationship mapping tools like Gephi and Maltego help visualize complex networks and identify suspicious patterns.

Tags Anonymous research Financial crime OSINT research